TrustTwo

Minimum Age

18

Debit Card

Yes

Credit Checks

Yes

Other Requirements

Guarantors can be homeowners, tenants or living with parents

Same Day Transfer Available

Yes

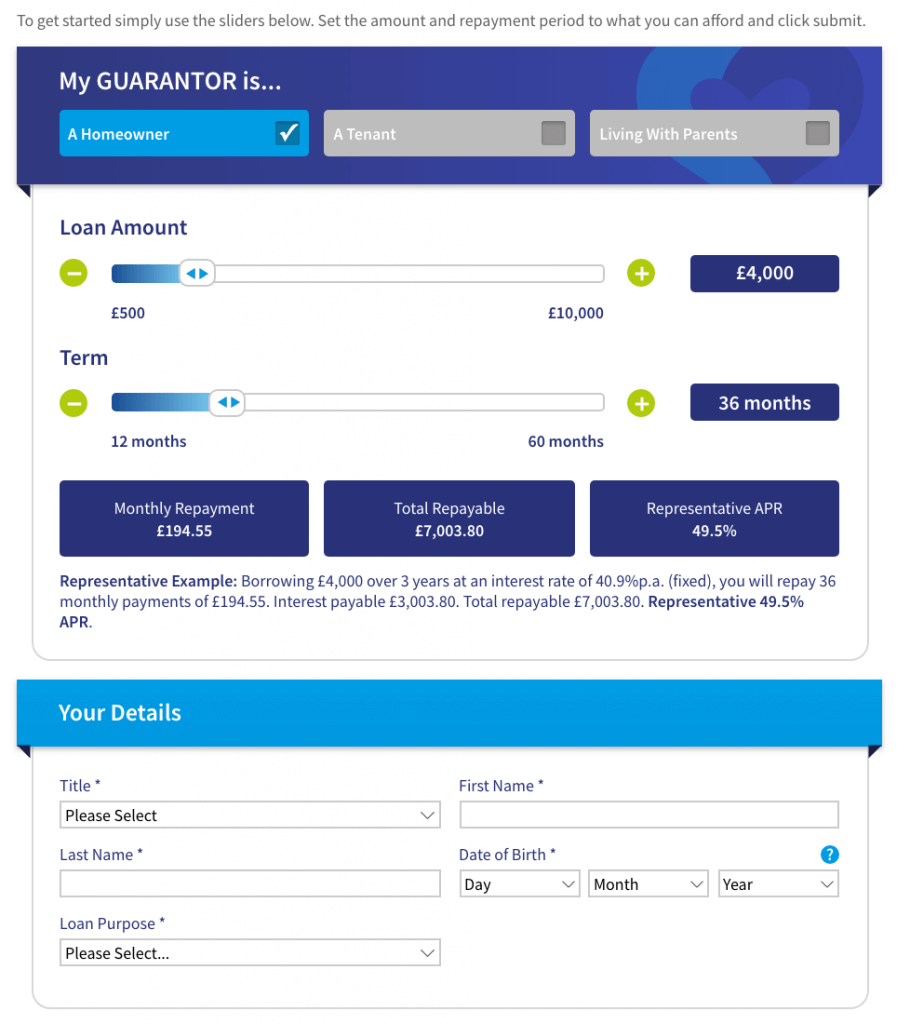

Loan Value Available

£500 to £10,000

Representative APR

49.5% APR

Loan Length

Up to 5 years

Credit License Number

588546

Direct

Direct

Lender guarantor

guarantor

lender credit

credit

check

TrustTwo are one of the leading guarantor loan companies in the UK, offering loans with a guarantor ranging from £500 to £10,000 repaid over 13 months to 5 years in equal monthly instalments.

With the name ‘TrustTwo,’ its all about two people coming together as part of the loan agreement and there is a level of trust involved when being someone’s guarantor. The website explains that the guarantor can be a family member, friend, work colleague but not your husband, wife or partner.

You might have heard TrustTwo’s jingle in their TV advert which is very catchy.

There are no fees for applying and as a direct lender, you can apply directly on their website, speak to their customer service team during the application process and if successful, they will transfer the funds to your guarantor’s account – therefore there are no other middlemen involved and you don’t have to worry about broker fees or your details being passed onto random third party companies.

What is the criteria for applying with TrustTwo?

There is a separate criteria for the borrower and the guarantor. For the borrower, they must have the following credentials:

- Over 18 years of age

- UK resident

- Email address and debit account

- Able to afford repayments (most likely through employment income)

- Not declared bankrupt, in IVA or have an active debt management plan.

For the guarantor, the criteria is as follows:

- Aged 25-74

- Able to afford your repayments (through their income or savings)

- Have a good credit history

- Can be tenants, homeowners or living with parents

- Working email address and debit account

Guarantors are required to be a little older to reflect the extra responsibility involved – after all, they will be required to repay the borrower’s loan if they default.

Furthermore, they should have a good credit history which suggests that they have repaid a number of other loans and forms of credit on time in the past and do not have any huge debts outstanding. By being a little older, it is also likely that they have accumulated a bit of a credit history which makes the application easier to process – rather than an 18 year old who has little or no credit history.

Both the borrower and guarantor are required to have a working email address and mobile phone so they can be verified and contacted at any time, whether during the application process, to notify you if there are any changes to your loan or if it involves following up on repayment.

How to apply with TrustTwo

Borrowers can apply directly with TrustTwo through our website by clicking on this link. We do not charge any fees or take any of your details when you apply – as an introducer regulated by the FCA, we are able to recommend the best lenders in the UK and we may receive an introductory commission if your loan is successful.

As an applicant, you will start by filling in your details and be given a unique link that you can send to your guarantor(s) where they can go and register. Provided that your guarantor has agreed to be part of the application, TrustTwo will need both parties to complete the loan agreement which highlights the terms and conditions of the loan including repayment dates, amounts due and responsibilities.

To reduce the need for hefty paperwork and the time it takes to fill in and post off documents, you are able to electronically sign the loan agreement.

TrustTwo state that: “We will only call you and your guarantor once you’re happy with the loan amount and repayments. Your eligibility for a Trusttwo loan is subject to our final approval.”

So the borrower and guarantor will go through various credit and affordability checks to determine how much they can borrow and if they are eligible – and this may require applicants to provide proof of employment via a pay-slip or bank statement.

If all the checks have been passed, the funds can be sent to the guarantor within three working days. The funds are always sent to the guarantor as an anti-fraud measure – so at least the money is sent to someone with good credit and the lender should be able to recuperate their funds if need be. The guarantor can then pass on the funds to the borrower or if they want to change their mind, they have a ‘cooling period’ and can send the funds back to the lender and the loan agreement will terminate.

Extra Information

Customers have the option to make addition repayments if they wish to, either paying weekly or topping up their monthly payment. This allows them to clear off their loan and outstanding balance more quickly and therefore pay less interest over the life of the loan. Trusttwo charge interest daily so your total cost of borrowing is always cheaper if you repay your loan early or ahead of schedule – if you are able to.

No information is reported back to credit reference agencies for guarantors, even if payments are missed, unless the account goes to court.

TrustTwo’s opening hours are Monday to Friday 9am and 6pm and they are open Saturdays from 9am to 12 noon.

Company registration no. 5850869

FCA Interim Permission No. 588546 (see FCA Register for validation)

Address:

Secure Trust House, Boston Drive, Bourne End, Buckinghamshire, SL8 5YS, UNITED KINGDOM