What is APR and Why is it used for Guarantor Loans?

APR stands for Annual Percentage Rate and is the standard measure of financial products all over the world. By all types of loans, mortgages and interests using APR, the idea is that it is easy to make comparisons between products and companies.

As the ‘Annual’ percentage rate, it refers to what the loan would cost if you took it out for an entire year. Since guarantor loans may only last a few months, the monthly rate is then compounded as if it were for a year and this is why the average APR of around 49.9% seems quite high.

So using APR may not be that accurate for the guarantor products and they are better suited for products that have annual interest rates such as mortgages, year-long loans and savings accounts.

Why is it used for Guarantor Loans?

APR is used for guarantor loans because this is a requirement of the FCA who are the regulatory body for the industry. Lenders must clearly state the APR on their website in a prominent position and all other marketing communications including TV advertising, banner advertising, leaflets and documentations. The presence of the APR allows applicants to understand the cost of the loan including a mention in the credit agreement that is signed upon accepting a loan. (Source: FCA)

How is APR calculated?

Calculating the APR is the responsibility of the lender, not the borrower.

There are at least three ways of calculating annual percentage rate.

1) Compound the interest rate for each year, without considering fees.

2) Add fees to the balance due, making the total amount the basis for computing compound interest.

3) Amortize the fees as a short-term loan. This loan is due in the initial payments. The remaining unpaid balance is amortized as a second, longer-term loan.

Another option is to take the interest/loan amount x 100

e.g with a Buddy Loan, you take out a £2,500 loan over 24 months and the interest is £1,250, so the total is £3,750 to repay

1,250/2,500 = 0.5 * 100 = 50% SIMPLE!

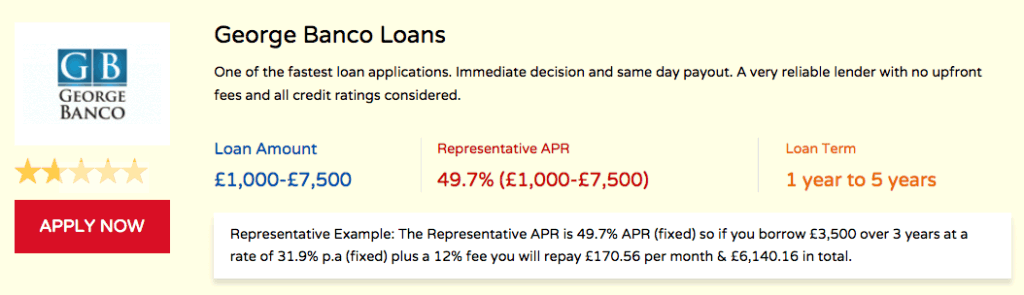

Here is the more complex formula for APR.

Types of APR

Fixed vs Variable APR

Fixed APR means that the rate charged stays the same throughout the entire loan term. So whether the loan lasts for 3 months or 3 years, the interest rate charged will always stay the same. The opposite of this is ‘variable’ meaning that the interest rate can change month upon month,

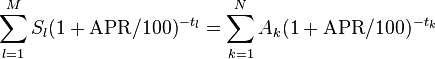

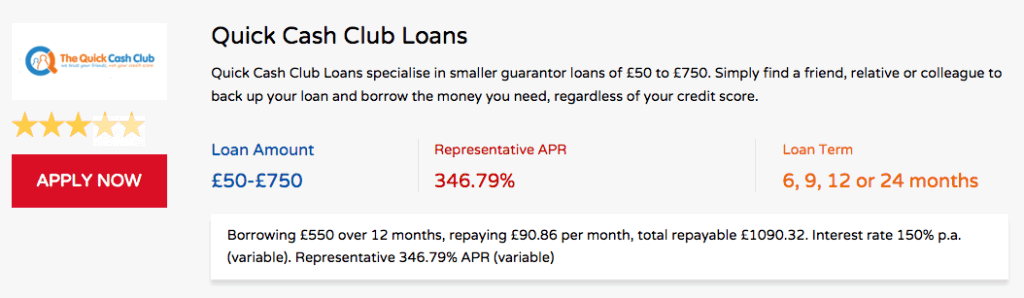

Whether the rate is fixed or variable is usually mentioned in the representative example on our comparison table and here are some examples below:

Representative APR

You may notice that whenever APR is mentioned on our site or on a guarantor lender’s site, it is presented as ‘representative APR.’ This means that this is the rate charged to at least 51% of customers that are successfully funded.

So whilst the APR may vary depending on your loan amount and loan duration, this is more or less the APR that you should receive.

Typical APR

If you ever see ‘typical’ APR, this is the rate available to at least 66% of customers that apply. So if you are applying, around two out of three people will receive this rate. This is less common for guarantor lenders who tend to show the representative rate instead.

Things to consider when looking at the costs of our loans

When you are looking to compare guarantor loans on our website, you will notice that a lot of the APRs are quite similar as they are either 39.9% or 49.9% and because this isn’t a huge difference, how do you know you are getting a good deal?

We recommend that in addition to comparing the APR, it is worth looking at the representative example to get an idea of how much you will be repaying and how it is broken down into monthly instalments.

In addition, you can look at the length of the loan and consider whether it is monthly or annually as this will certainly impact the rate of APR.

Also, if you find yourself in a position where you can clear your debts and repay early, most of the lenders we feature will allow you to do so and they won’t charge you anything extra. In fact, repaying early will decrease your overall repayment and this will reduce the APR.

Consider the alternatives

At the end of the day, you need to find a loan that is right for you and the APR allows you to do this quite effectively. When considering the alternatives, you can use the APR to indicate how much you will be expected to repay and here are some of the options below:

- payday loans – average APR is 1,300%

- credit cards – 18.9% (variable)

- credit union loans – 26.8%

One of the reasons that a payday loan is so high is because a typical one only lasts for 14-45 days and then it is annualised as if it were for a year, causing it to be thousands of per cent. For a more accurate cost of a payday loan, look at the cost per £100 borrowed or the daily interest rate, which has been capped 0.8% per day.

Credit cards are also expensive though and going into your overdraft can be more costly than a payday loan. The APR appears low because the calculation is based over the period of a year.

Credit unions are not-for-profit organisations that offer super low interest rates. Based in specific areas, you can go to your local credit union and to be eligible, you must be part of a particular income bracket or have a particular public sector job such as policeman, fireman, nurse or teacher.

If you are experiencing money problems, go to moneyadviceservice.org.uk